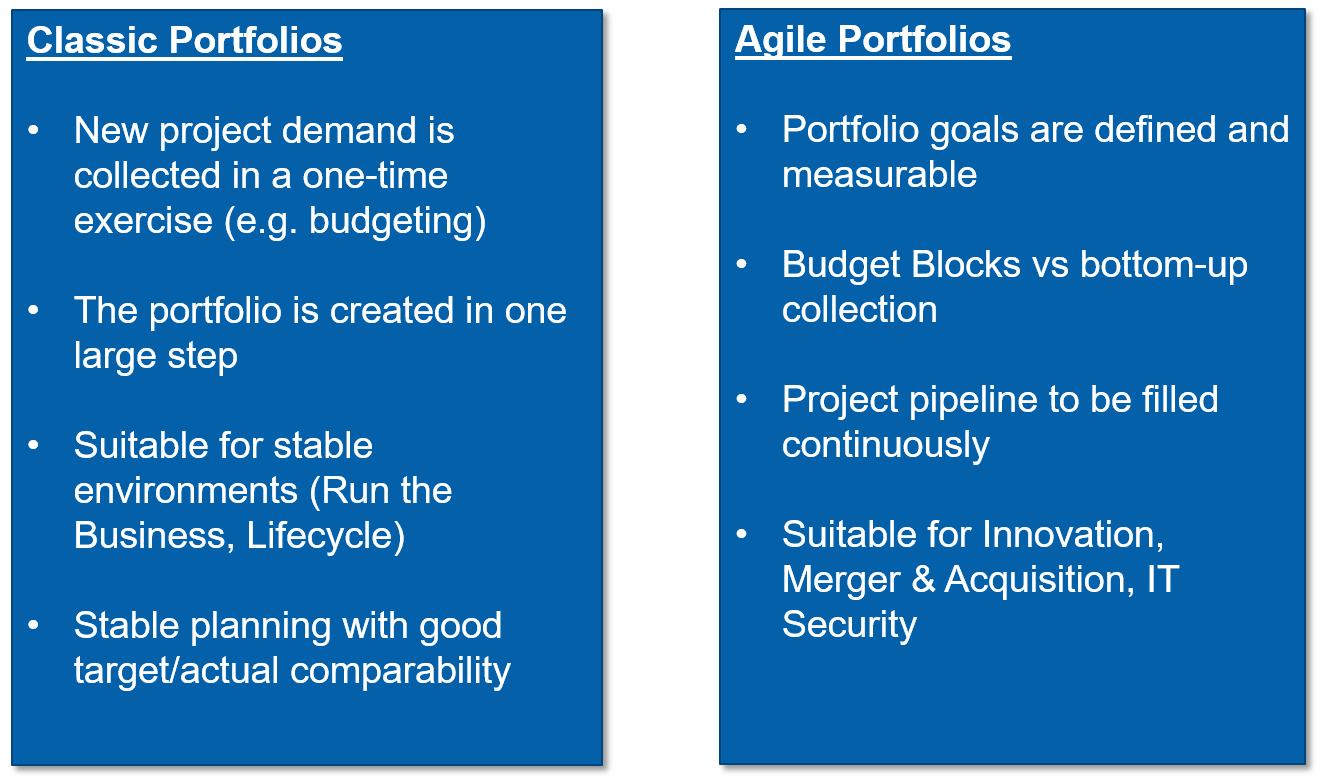

Portfolio management has changed considerably over the years. While at the beginning it was an input for the annual budgeting (classical portfolio management), nowadays one sees more and more agile portfolio management approaches, which differ essentially in the fact that one skips the budget stage and coordinates new project ideas directly with the portfolio, prioritizes and executes them.

A rough distinction can be made between classic and agile (rolling) portfolios. In the first case, the projects are prioritized, usually during a budgeting phase, and added to a pipeline, similar to pouring water into a bucket. This pipeline is processed after budget release. Changes to this pipeline are possible, but remain the exception.

Agile procedures have been used in project management for a long time to carry out projects that are difficult to plan. The project plan is essentially replaced by a change process that ensures that the project is not chaotic and does not come to a result.

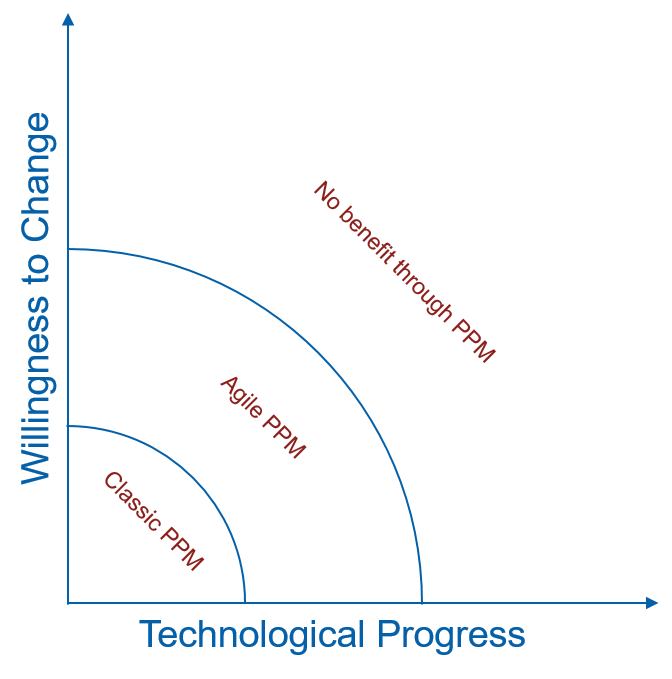

Agile approaches can also be advantageous for portfolio management if planning over a longer period is not possible or does not make sense. This is particularly the case with IT project portfolios, where on the one hand the agility of the entire organization is transferred to IT (e.g. digitization) and on the other hand technological change is progressing in ever faster steps, such as in cloud computing. The two dimensions can be used to determine how much agility the portfolio management needs.

In the classic segment, where the willingness to change is rather low and the technological change is not significant (e.g. railway network), projects can be planned well in advance, while - as already mentioned - in the IT segment the planning horizons are considerably lower. If management then adds a strong will to change, classic portfolio management will no longer deliver any benefits. In return, management also has to forego detailed budgets and finance portfolios instead of individual projects.

With very intense change, it is becoming increasingly difficult to manage a portfolio in a targeted manner. In this case, at least the will to change on the part of the management must be discussed, otherwise it would get too chaotic.

Both types of portfolio management can be performed in coexistence as long as the fields of activity are correctly defined. It is important that appropriate portfolio governance exercises the processes correctly.